|

|

Post by cestlefun17 on Nov 14, 2011 3:54:08 GMT -5

UPDATE: House DEFEATS Balanced Budget Amendment 261 in favor, 165 against. 23 additional votes were needed for passage.

====

This week, the House of Representatives will be voting on a proposed amendment to the United States Constitution, requiring Congress to pass a balanced budget. Below is the version of the amendment that has been selected.

This is quite exciting as this is the first time in a long time that it looks like an amendment to the United States Constitution has a good chance at being ratified. I am pleased that the amendment does not require a super-majority to raise taxes, and I am very pleased with the final text.

What are your thoughts?

===

Section 1. Total outlays for any fiscal year shall not exceed total receipts for that fiscal year, unless three-fifths of the whole number of each House of Congress shall provide by law for a specific excess of outlays over receipts by a rollcall vote.

Section 2. The limit on the debt of the United States held by the public shall not be increased, unless three-fifths of the whole number of each House shall provide by law for such an increase by a rollcall vote.

Section 3. Prior to each fiscal year, the President shall transmit to the Congress a proposed budget for the United States Government for that fiscal year in which total outlays do not exceed total receipts.

Section 4. No bill to increase revenue shall become law unless approved by a majority of the whole number of each House by a rollcall vote.

Section 5. The Congress may waive the provisions of this article for any fiscal year in which a declaration of war is in effect. The provisions of this article may be waived for any fiscal year in which the United States is engaged in military conflict which causes an imminent and serious military threat to national security and is so declared by a joint resolution, adopted by a majority of the whole number of each House, which becomes law.

Section 6. The Congress shall enforce and implement this article by appropriate legislation, which may rely on estimates of outlays and receipts.

Section 7. Total receipts shall include all receipts of the United States Government except those derived from borrowing. Total outlays shall include all outlays of the United States Government except for those for repayment of debt principal.

Section 8. This article shall take effect beginning with the later of the second fiscal year beginning after its ratification or the first fiscal year beginning after December 31, 2016.

===

|

|

|

|

Post by ltfred on Nov 14, 2011 4:18:29 GMT -5

An extremely bad idea. Like, unbelievably bad. It is perfectly legitimate for governments to run deficits, permanent, constant deficits. The last time the US ran a surplus was in the 1920s, and we all know how that ended out.

All this ammendment would do would be to constrain policy when fighting recession. The US economy would suffer worse, longer downturns without the abillity to easily borrow money. This ammendment might even harm the US's credit rating. In any case, it would significantly harm the economy in the name of conservative ideological purity.

Edit: That's if the ammendment does anything at all. It's quite likely that the congress would just permanently declare a state of war, and therefore avoid it. This would be the least bad thing that could happen.

|

|

|

|

Post by Damen on Nov 14, 2011 4:25:04 GMT -5

I personally find this to be little more than political grandstanding.

|

|

|

|

Post by Haseen on Nov 14, 2011 6:32:13 GMT -5

An extremely bad idea. Like, unbelievably bad. It is perfectly legitimate for governments to run deficits, permanent, constant deficits. The last time the US ran a surplus was in the 1920s, and we all know how that ended out. All this ammendment would do would be to constrain policy when fighting recession. The US economy would suffer worse, longer downturns without the abillity to easily borrow money. This ammendment might even harm the US's credit rating. In any case, it would significantly harm the economy in the name of conservative ideological purity. Edit: That's if the ammendment does anything at all. It's quite likely that the congress would just permanently declare a state of war, and therefore avoid it. This would be the least bad thing that could happen. This x1000. Depressions are a normal feature of an economy without Keynesian policies. Stimulus works, and the economy would be a lot better right now if Republicans didn't arbitrarily* decide that we owe ourselves too much money. *Technically not arbitrary, because it was intentionally done to hurt the economy and blame Obama. |

|

|

|

Post by cestlefun17 on Nov 14, 2011 7:37:39 GMT -5

The situation in the 1920s is entirely different than it is today. The Great Depression wasn't caused by a budget surplus, but a myriad of complex factors, namely the bankrupting of Germany through World War I reparations, which had to pay off the Allies' own war debts through incredibly devalued marks.

Increased spending during a recession is a good idea. But someone has to pay for it (perhaps by, say, raising taxes on the top 1% rather than borrowing). When you borrow money, it has to be paid back at some point with interest. Constantly borrowing money, with no plan for full repayment, will only serve to land us in a financial quagmire that will be increasingly difficult to dig ourselves out of.

The bill already has 242 co-sponsors, which means 242 guaranteed votes. It needs 290 to pass the House and I think that it can easily pick up that many votes. Fiscal conservation is very much in vogue, and considering that the amendment does not require a super-majority to raise taxes, it is appealing to both parties. I seriously think we are looking at Amendment XXVIII to the United States Constitution here.

|

|

|

|

Post by Yla on Nov 14, 2011 8:27:16 GMT -5

I don't get the point of section 4. Can someone explain that to me?

In general, a constitutional obligation to a sound budget is good in my book. If there is actually a need for expensive short-term measures, then the amendment has the required loopholes anyway [/semi-sarcasm]

ltfred, can you explain to me how your hypothetical budget which spends with abandon would work long-term? Where is that money to come from? What would you change instead?

|

|

|

|

Post by cestlefun17 on Nov 14, 2011 8:37:36 GMT -5

There are two main ways to take a vote in Congress: voice vote and roll call vote.

On a voice vote, the measure is read by the Chair, who then asks: "All those in favor say AYE." Those voting in the affirmative say AYE. The Chair then asks: "All those against say NAY." Those voting in the negative say NAY. The chair then judges who had more people and says: "Without objection, the AYES/NAYS have it and the motion PASSES/FAILS." If someone objects to the result read by the Chair, and this motion is seconded, then a roll call vote is conducted.

Under voice vote, the exact number of people voting in favor or against is not recorded, nor do the members go on record as voting either for or against a measure. Under a roll call vote, each member's vote is recorded individually and goes on record. Section 4 requires that if Congress votes to raise taxes, each member must go publicly on record as being for or against the bill.

|

|

|

|

Post by erictheblue on Nov 14, 2011 8:49:07 GMT -5

Increased spending during a recession is a good idea. But someone has to pay for it (perhaps by, say, raising taxes on the top 1% rather than borrowing). You are dreaming if you think this will be a common occurrence. Just about every nation borrows and pays interest. There are occasional times when the US (and other nations) run a surplus, but those are few and far between. What is the status in the Senate? You are wrong. A super-majority may still be required. The amendment only requires a majority of each House to approve the bill. Nothing in the amendment requires either House to actually vote on it. Senate Republicans can (and likely will) filibuster any bill that raises taxes. And that is assuming the Democrats control the Senate. If Republicans are in charge, those bills will never make it close to the floor. A balanced budget amendment was first proposed by Thomas Jefferson in 1789. Another one was proposed in 1936. One passed the House and was 1 vote shy in the Senate in 1995. They have been brought up off an on since then, with all of them dying on Capitol Hill. Also, 34 states have to ratify it. Since 1975, only 32 have petitioned Congress to take up such an amendment. It cannot even be assumed that all 32 of them will actually ratify such an amendment, as much has changed in state governments in the past 36 years. |

|

|

|

Post by N. De Plume on Nov 14, 2011 9:26:34 GMT -5

Talk about short-sighted. Especially love that it requires a balanced budget but then it makes it more difficult to actually meet that goal by increasing revenue. In general, a constitutional obligation to a sound budget is good in my book. If there is actually a need for expensive short-term measures, then the amendment has the required loopholes anyway [/semi-sarcasm] Yeah, cause both major parties have shown a willingness to pass those sorts of short term methods rather than let the country go to hell over misguided party ideals[/total-for-real-sarcasm] |

|

|

|

Post by Vene on Nov 14, 2011 10:15:45 GMT -5

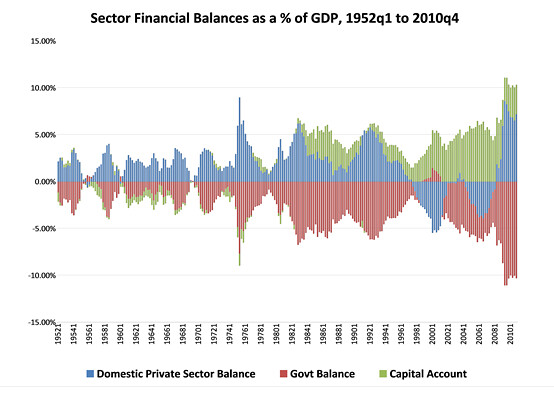

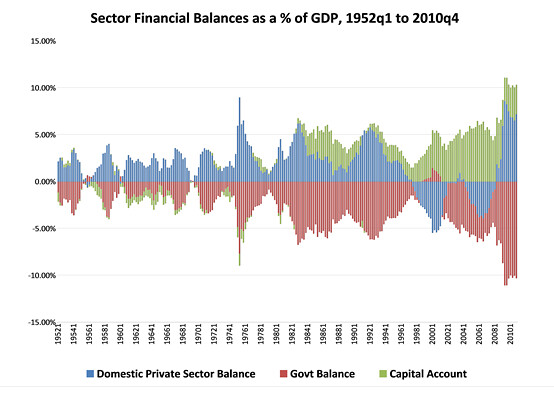

This is a stupid idea. Here is part of why it is stupid, a little equation: Government deficit = Trade deficit + Total private savings  Here is another reason why it is stupid, we can mint money as we please. And when we have a labor surplus, inflation is such a non-problem that we are not going to hit hyperinflation. There's also the whole thing about OPEC using the dollar which gives it a lot of power and a lot of stability. Debt is not an automatic bad, unmanageable debt is, we are not at that point and not reaching that point (and even if we were, requiring the US to balance it completely is an overreaction). |

|

|

|

Post by cestlefun17 on Nov 14, 2011 11:46:20 GMT -5

I realize this...but at least the amendment leaves open the possibility. It does not bind Congress' hands in terms of tax increases, which is an absolute must for me to support the amendment.

The amendment won't abolish the national debt; it'll help to reign it in. Just about every nation borrows and pays interest, yes, and we're also seeing a global depression. Europe is being hit hard too. How long will this philosophy be sustainable? Everyone constantly borrowing more and more money from everyone else.

All of this is already true even without the amendment.

I think the political climate is far different, especially since 1995 when Bill Clinton was able to actually balance the budget without an amendment.

|

|

|

|

Post by ltfred on Nov 14, 2011 16:59:07 GMT -5

ltfred, can you explain to me how your hypothetical budget which spends with abandon would work long-term? Where is that money to come from? What would you change instead? Firstly, as Vene pointed out, public debt is just one form of debt. Household debt is exactly equal to the difference between public debt and the trade deficit. So, if you have a high trade deficit and a low public debt (as with Australia) you have an extremely high household debt. Household debt is way worse than government debt. It's pretty hard to overleverage a government when the economy is booming, and it's pretty easy to reorganise if a state defaults (Argentina and so on). Government debt doesn't really have much of a macroeconomic effect, aside from a slight inflationary pressure. On the other hand (as the US is now finding out) an overleveraged household sector will lead, in the long run, to a massive demand crunch, near-destroying the economy and causing long-term economic damage. A disproportionate amount of debt burden of the balance of trade should be assumed by the government. Also, the balance of trade should be made neutral in the long run; it's completely irresponsible to be a deadbeat on trade in the long run. How did* this work in the long run? If a government runs a budget deficit lower than the GDP growth rate, the debt decreases. This is because government debts are measured as a percentage of GDP. So the debt/GDP ratio decreased steadily from 1945-1960 even though the US ran budget deficits, because the GDP growth rate was higher. What congress is saying is that this is an unacceptable strategy- the US has to run budget surplusses even though the debt would be reducing anyway (and the public have to assume way higher mortgages) because..... well, because. Responsibility! *I say did with advisement. The US has run a continuous federal budget deficit from 1930-2011. |

|

|

|

Post by Vypernight on Nov 14, 2011 17:31:38 GMT -5

Aren't we in a recession because people were spending money they didn't have? And I thought having a surplus was a good thing. Finally, if we mint more $ than we have gold to back it, doesn't that make things worse by devaluing it?

I'm not an economics expert, and if I missed something, that's fine. It's just that the arguments against the BBA don't make much sense to me.

|

|

|

|

Post by ltfred on Nov 14, 2011 17:44:36 GMT -5

Aren't we in a recession because people were spending money they didn't have? The US is in recession because people aren't spending money they don't have any more ^. That's led to a demand shock, which has led to mass unemployment as people reduce their debt burden. It's also led to increased government budget deficits. The only way to get out of this is to stimulate demand, to return it to pre-recession levels. But, at the same time, households have to be allowed to reduce their debt burden. That implies 1) a trade surplus (which means a devaluation of the Dollar, particularly in comparison with the Yuan) and 2) short-to-medium government debts and 3) an end to the neo-liberal consensus and the resignation of all neoliberal economists in shame. ^ Also because several people allowed household debt to build up and build up, covered by bubbles. Apparently debt didn't matter any more. Like I said, a trade surplus is good. Assuming that you don't have one, it's better that the debt be made up in government borrowing rather than private. And there's never really any need for an absolute budget surplus (as this ammendment calls for). Nobody has backed money in gold for decades and nor should they. Devaluing the currency can actually be very good for an economy, by making export industries more competitive*. That's what China is doing at the moment, the bastards. If exports are more competitive, you have greater real demand for goods and, obviously, a lower trade deficit. * If you devalue your currency compared to other currencies, you're effectively selling goods for cheaper. |

|

|

|

Post by Haseen on Nov 15, 2011 5:27:01 GMT -5

Aren't we in a recession because people were spending money they didn't have? And I thought having a surplus was a good thing. Finally, if we mint more $ than we have gold to back it, doesn't that make things worse by devaluing it? I'm not an economics expert, and if I missed something, that's fine. It's just that the arguments against the BBA don't make much sense to me. Basically, debts and surpluses tend to smoothen out the business cycle by pumping money into the economy when it needs it the most, and taking it back out when it can best afford it. With a forced balanced budget, recessions get much worse and last longer. The up cycles may seem nice, but they also have high inflation... not so nice. You can also google Keynesian Economics if you want more detail than I could possibly give you. |

|